M&A integration: is it always messy?

Lessons learned from integrating B2B SaaS companies. How to mitigate the messiness and increase your chances of creating enterprise value.

I recently had the pleasure of catching up with a long-time friend and successful CEO . His current company was beginning to evaluate M&A opportunities to expand their product suite and asked me a simple question: “Are all integrations just naturally messy?”.

Over the last 2 years, I’ve had the opportunity to be a part of and led the integration of 7 acquired B2B software companies ranging from $1 million to $10 million in ARR. For some companies, M&A roll-up is a core corporate strategy requiring a core competency of integration to be built over time. For most companies though, there’s 1 or 2 significant acquisitions that could catapult the enterprise forward - or, if not executed well, stall enterprise value progress and raise your cost basis overnight. In my experience, combining 2 companies together is always a big undertaking but my optimistic gut reaction to his question was, there’s a better way. That question got me thinking though…what exactly is the better way?

Here are my lessons learned and watch points for any B2B software company looking to acquire and prepare for a successful integration in the next 6-12 months.

Note: these experiences stem from acquisitions of companies of <50 employees. While themes are applicable for larger acquisitions, examples and applications may vary.

—-

First things first - it would be a mistake to not qualify that all post-merger integrations aren’t made equal. These are large B2B transactions that have strategic, financial, operational, and people dynamics that impact the scope, risk and complexity of every acquisition.

Strategic objective: market consolidation, product add-on, geographic expansion

Financials: combined SaaS metrics, debt financing, equity rolled from previous owners,

Operational: go-to-market motion maturity, accounting / CRM landscape,

Technology: integration plan, platform decisions, differing software development processes

People: founder / executive motivations, key employee risk, culture differences

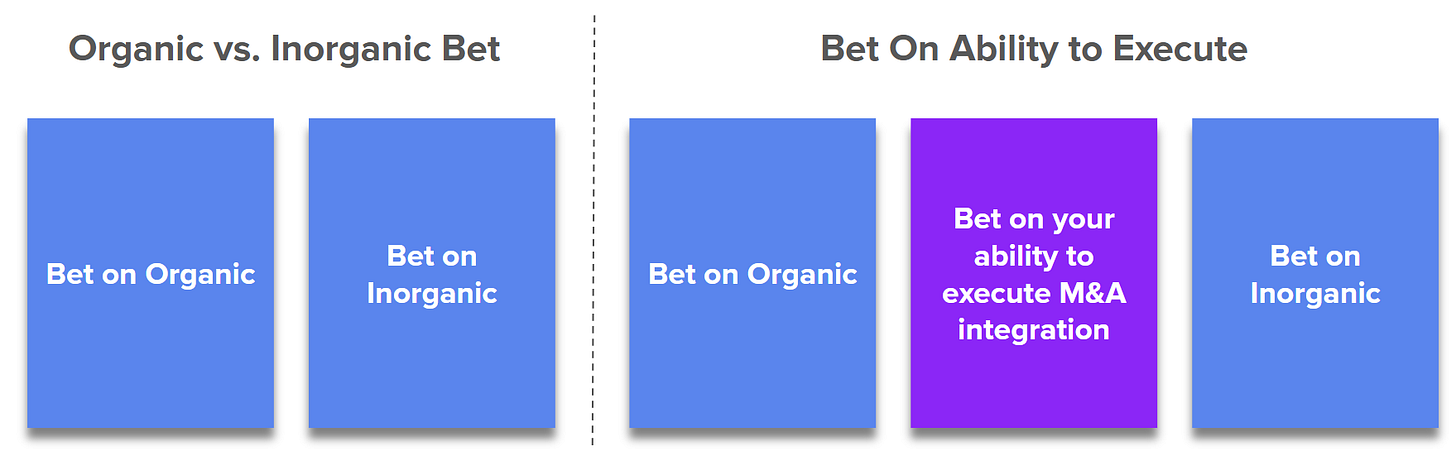

Despite these differences, the choice is this: you could allocate capital and resources toward (a) organic growth and profitability initiatives, or (b) bet on acquiring an asset. According to Harvard Business Review, 70–90% of mergers and acquisitions (M&As) fail to achieve their expected value during post-merger integration phase. Further, if you’ve lived through M&A, it’s likely you’ve witnessed the clunkiness and mess of bringing 2 or more companies, products, teams, cultures together. So despite the corporate strategy, investment banking analyst, and pre-close deal diligence, realizing enterprise value comes (a lot) down to your ability to execute. That’s what you ought to be betting on assuming that there’s a lot of good brainpower poured into “picking the right horse”.

Here’s some learnings (through mistakes) on how to maximize your chances of realizing the enterprise value you signed up for, and minimize the messiness in the process.

Integration starts pre-close - diligence is taxing but it’s temporary. You’ll have to live with what happens after.

Pressure test your operations - the more your own house is in order, the easier it is to integrate.

You’re hiring as much as buying - approach it as if you’re hiring a whole team, all on the same day.

Expect to fire someone - right people, right seats.

Resource for integration like a project - it should be disruptive

Don’t claim “Business as usual”

Build in quick wins during onboarding

Develop advocates and influencers

1 | Integration starts pre-close. Start building momentum well before closing the deal.

Integration starts well before you close the deal and arguably even before you start sourcing. You don’t control when and why sellers are open to sell, meaning that oftentimes, you have to be ready to “catch” the opportunity when it arises rather than slotting it into a preplanned roadmap.

Strategically, this means having a well communicated and understood strategy by your current team, including the potential of leveraging M&A to accelerate that strategy. Is geographic TAM expansion of interest? Do we have a product gap that needs to be solved? Is our market saturated where it’s easier to acquire customers through acquisition? It’s ok not to have all the details and options disclosed but the outcome is this - when an acquisition happens, you want it to be a win to your team, not a surprise.

Externally for your sourcing and buying evaluation, this allows you to align on the strategic win-win from the first introduction meeting. Be mindful that sellers are exceptionally motivated financially. They’ll hear what they need to hear, and say what they need to say. While you’re signaling to your team, the sellers are signaling the strategy to their team and you’re counting on those stories to be aligned. You’re counting on the team you’ve just acquired to execute on the new unified strategy. If they’ve heard something different or been misled, you’re already behind the eight ball.

2 | Pressure test your operations - the more your own house is in order, the easier it is to integrate.

The more definition you have of your core operations, the easier it is to integrate another company. An extreme scenario is a merger instead of an acquisition. In a merger, companies are on a more equal playing field. While that sounds fairer, decision making authority is less clear and you can spend a lot of time creating something new rather than integrating into a working “core” that’s already in place.

Start by referencing the operating methodology your company uses, whether EOS or other.

Is your vision, mission, values aligned across your company?

Do you have regular, transparent data visibility to core operating metrics?

Do team members all have goals and metrics they’re accountable for?

Is there a regular communication rhythm in place?

Do you have core systems in place (accounting, CRM, etc.)?

Etc.

The result is 3 things: (1) it’ll make your operations better anyways even without the acquisition, (2) you’ll have a punch list to scope items to address as part of the integration prep, (3) these become easy wins to demonstrate trust of your new comrades (more later). After all they want to know they just joined a rock solid company and there’s more upside to working for their new employer.

3 | You’re hiring as much as you’re buying

For smaller B2B software shops (<50 employees), the single largest integration risk is losing key employees of the company you’re acquiring. Product & customer knowledge as well as decision making is typically centered around a handful of team members. In addition, roles & responsibilities aren’t well defined, software code isn’t well annotated, processes aren’t documented, and data often requires deep business knowledge to interpret. What’s this mean? You’re hiring a team as much as you’re buying a company. Go in with that mentality.

Ask the right questions - what’s their motivation? Where do they see their role being in a larger company? What’s a homerun for them?

Spend as much face-to-face time as possible. It’s easy to hide expressions and intentions behind the mask of diligence related zoom calls. Make an excuse for an in-person working session. Take them out to dinner, get to know them and ask the same questions with their guard down.

Get a talent inventory and define core organization design tenets that align with the investment thesis. For example, will you roll acquired team members under current functional departments or should you keep them as a separate business unit? Do you need to create roles for key executive leadership team members? If so, what will their distinct remit and objectives be, and will they be happy in those roles?

Get employment agreements in place to mitigate your risk for key employees, but just as important, communicate what you think their roles could be and set proper expectations on the process to define those responsibilities. These employees are typically the largest influencers to bring the rest of the acquired team along so a high touch is warranted. Quick tip: if at all possible, avoid performance-based earnouts for individuals. You don’t know enough at the time of close to design these in a way that are aligned to your company objectives.

A tangible output well before you close the deal is a draft organizational structure to validate and roll out in the first 30 to 60 days.

4 | Expect to fire someone

For those that subscribe to “right-people-right-seats”, this is an extreme application of that principle. Normal hiring goes like this: make the business case > define the role > recruit the right fit.

Contrast that with an acquisition. You’re taking in say 20 new team members, at the same time, where the roles haven’t been fully defined. The reality is some of those seats may not be needed, OR similar seats will need new people in those seats because the scope is bigger or different.

Be objective about the business needs. Everything is in service of creating the value assumed in the investment thesis so if hard calls need to be made, it’s normal.

Do discovery. The same job title doesn’t mean the same responsibilities. For example, “Customer Success” may really be answering customer tickets rather than driving renewals and owning customer relationships. “Business Development” may mean outbound SDRs, or it may be a quota-carrying sales rep. “Product Manager” may be more of a technical project manager rather than having product management ownership by your definition.

Discovery also uncovers the “extra” job activities. For example at a small company, an account manager may take on collections for key accounts. If you don’t transition or backfill that responsibility, you may find yourself triaging cash collections for a few large accounts.

If you know early on that there’s not a fit for key employees, name it. Talk it through and be clear on the assignment and timetable so you can (a) still get value while they’re with you and (b) graciously offboard employees so they speak highly of you even on their way out.

5 | Resource for it like a project

It’s easy to fall into the trap of aligning ownership to your respective department leads. Don’t. They should be stakeholders on the project or even workstream owners but they don’t have the time to lead. While you’re integrating, sales still needs to sell, marketing needs to create leads, engineering needs to make progress on the product roadmap. To put it in perspective, onboarding 20 people at once is a pretty big endeavor. A new product launch takes focus and attention to do well. Training your sales force on a new product or market takes time. In an integration you may be doing all of that at the same time.

The resourcing basics:

Get a dedicated project manager - this is a great fit for a Chief of Staff, Corporate Development lead, or head of operations. But even then, you may need to clear their agenda.

Seek an advisor - this may be a board member or operating partner, ideally with M&A integration experience. You’re too close to the details and there are hard decisions you’ll need to make that help to have a fresh set of eyes that’s at arms’ length from the people dynamics.

Identify technical work and resources - this goes to both the software engineering technical work to integrate platforms if applicable, but also your operational systems work. On the simplistic end, you’ll need to at least merge or migrate data between accounting systems and CRM instances.

6 | Don't claim “business as usual”

Never claim “business as usual”. It’s not. You just totally pivoted the course of the company they knew (or at least the perception of it). Even in a scenario where the acquired business operates as a separate business unit, things will be different.

Leaders of that BU are no longer at the top of the food chain

BU budgets still have limits that need approvals

Blended company goals are different

Operating systems and processes will change

Team members’ relative brand and credibility within the new organizations need to be rebuilt

Rather, be explicit that things will change, that they will change for the better, but only if you have their help. More importantly, follow through. Create a consistent talk track across your executive team on the WHY behind the acquisition so that there’s clarity and consistency in every interaction. Conduct active listening tours to get to know the acquired company team members’ and use that as a launching point to develop quick wins and advocates that can scale your change management.

This goes for the acquirer too. Your existing employees ought to know that it’s also not “business as usual”. Of course, their job responsibilities in many cases may not be as directly impacted as the acquiree but you need your own team members to be part of welcoming new team members in, understanding the integration plan and how new products and team members fit into the overall company strategy.

7 | Build in quick wins during onboarding

When you hire a new employee, you don’t wait 3 months to onboard them. It’s the same here but at a bigger scale. Do it immediately and do it joyfully. And most importantly, build in quick wins. Ideally, this is linked to the core investment thesis but that’s not always possible within the first 90 days. For example, if you’re acquiring a company as a product extension, the product launch may be 6 months out but build in milestones like a company demo, a walk through of a prototype, post a list of interested beta customers..

Day of close (plus or minus a day) - on-site welcome and celebration, delivery of the “why” behind the merger and high level of what to expect. But most of all, have fun! The best thing you can do is humanize things. Let new employees meet and see that their new leadership can kick back and relax.

Week 1

Overview of the integration plan and who’s in charge. This is important (they are important) and you’ve dedicated resources to it. Name the knowns and the unknowns. This is your first opportunity to build trust. They need to know you have a plan, but also know they have a place for input.

Express the roles and/or transition plan of their prior leadership. The team needs to know their leadership is on board for the ride and understand their role going forward.

Kick off a listening tour led by your executive team

Week 2

New team members go through standard onboarding to understand the organization, the product, customers, and organization.

Key employees are presented and sign their employment agreements

Set up weekly office hours as a regular feedback loop on integration updates and to receive feedback / questions.

Share product demos

End of first month

CEO + exec team visit for a readout of their listening tour findings. Use this to fill in the unknowns from the plan with a proposed path forward. Ideally, this includes participation from new team members on specific projects so they feel part of the

Kick off departmental summits to knowledge transfer and plan for their integration

Employees on key communication channels (may not have emails fully merged yet).

8 | Develop advocates and influencers

Quickly identify which key employees are bought into the strategy that have influence. Most definitely the CEO and executive team but also look for individual contributors.

As much as you want to promote transparency and a culture of openness, the reality of your new team is that there is FUD (fear, uncertainty, and doubt) everywhere so you can’t expect everyone to be an open book from day 1. Get new team members involved in cross-functional initiatives, call them by name in company townhalls so they feel known, spend time in person to get to know them and start building trust. Pretty soon, they’ll be in the “hallways” advocating for NewCo and helping to fight the inertia of how things used to be.

After reflecting on the past successes and failures of integrations, I think it’s safe to say that integrations can be messy but they don’t have to be. Like many things in business, it takes:

A mentality that integration starts well before deal close. Setting it up for success means strategic alignment and developing an operating plan well in advance of deal closing. Otherwise, you’re already too late and will be reacting for the next 6 months.

Prioritization, focus, and dedicated resourcing to plan and execute in a coordinated way across all functions

A priority on organizational design and people. It’s about building trust from day 1 and ensuring you have the right-people in the right-seats.